are dental implants expenses tax deductible

Any 7 should be regarded as a good thing to remember. Taxpayers will be able to deduct dental implants from their income for taxable purposes.

Are Dental Costs Tax Deductible In Canada Cubetoronto Com

Replyyes they qualify after youve reached the 3 of your gross income.

. That 20 is the portion you can. Medical expenses are an itemized deduction on Schedule A and are deductible to the extent they exceed 10 of your adjusted gross income AGI. A taxpayer who earns 5000 a year is entitled to deduct 5 of his or her gross income.

Expenses related to OTC toothpaste dental floss mouthwash and general care products are typically not considered tax-deductible either. The IRS states that the total paid for dental implants can be reported as a medical expenditure on Schedule A Itemized Deductions. You can claim the portion of the procedure that you pay also known as the co-pay.

If you are 65 or over they are deductible to the extent they exceed 75 Please click here for more information. Yes if they are not merely cosmetic and the dentist has recommended them as treatment for your dental condition. Other dental work not paid by your insurance plan.

Generally the Internal Revenue Code allows as a deduction the expenses paid during the tax year not reimbursed by insurance for medical care of the taxpayer his or her spouse or a dependent to the extent that such expenses exceed 10 of adjusted gross income. For example if your insurance covers 80 of the cost of treatment for denture implants or dental implants you are responsible for paying the remaining 20. This brings us back to the question Are porcelain crowns dental implants and fillings medically necessary.

Remember though that your itemized deductions for medical dental expenses are reduced by 75 of your Adjusted Gross Income AGI and that total itemized deductions including whatever is left of medicaldental expenses after subtracting the 75 will save tax. Most dental expenses can be used as medical expense deductions when filing your income taxes in Canada including. Even if you have insurance coverage that includes implant treatment you could still receive a tax credit.

Are dental implants tax deductible. Employer-sponsored premiums paid under a premium conversion plan cafeteria plan or any other medical and dental expenses paid by the plan arent deductible unless the premiums are included in box 1 of your Form W-2 Wage and Tax Statement. Yes dental implants are an approved medical expense that can be deducted on your return.

So that means its not possible to deduct the cost of in-home or in-office teeth whitening. There are no automatic deductions so you must itemize them. You can only have seven good things to remember right now.

Yes dental implants are an approved medical expense that can be deducted on your return. Your dental implant expenses are tax-deductible in the United States per IRS guidelines clearly stating that payments made for artificial teeth qualify. A dental implant is a tax-deductible expense yes.

If one or two crowns are placed to rehabilitate your bite due to an accident illness or disease they. For example if youre a federal employee participating in the premium conversion plan of the Federal Employee. If youre wondering whether cosmetic surgery dental implants LASIK or other medical expenses are tax deductible the IRS has a document for you.

A Strategy To Benefit From the Medical Expense Tax Break. The only exception is dental work that is purely cosmetic such as teeth whitening.

3 Irs Dental Implant Discount Plans Tax Deductible Savings Dental Implants Irs Taxes Tax Deductions

Are Dental Implants Tax Deductible Atlanta Dental Implants

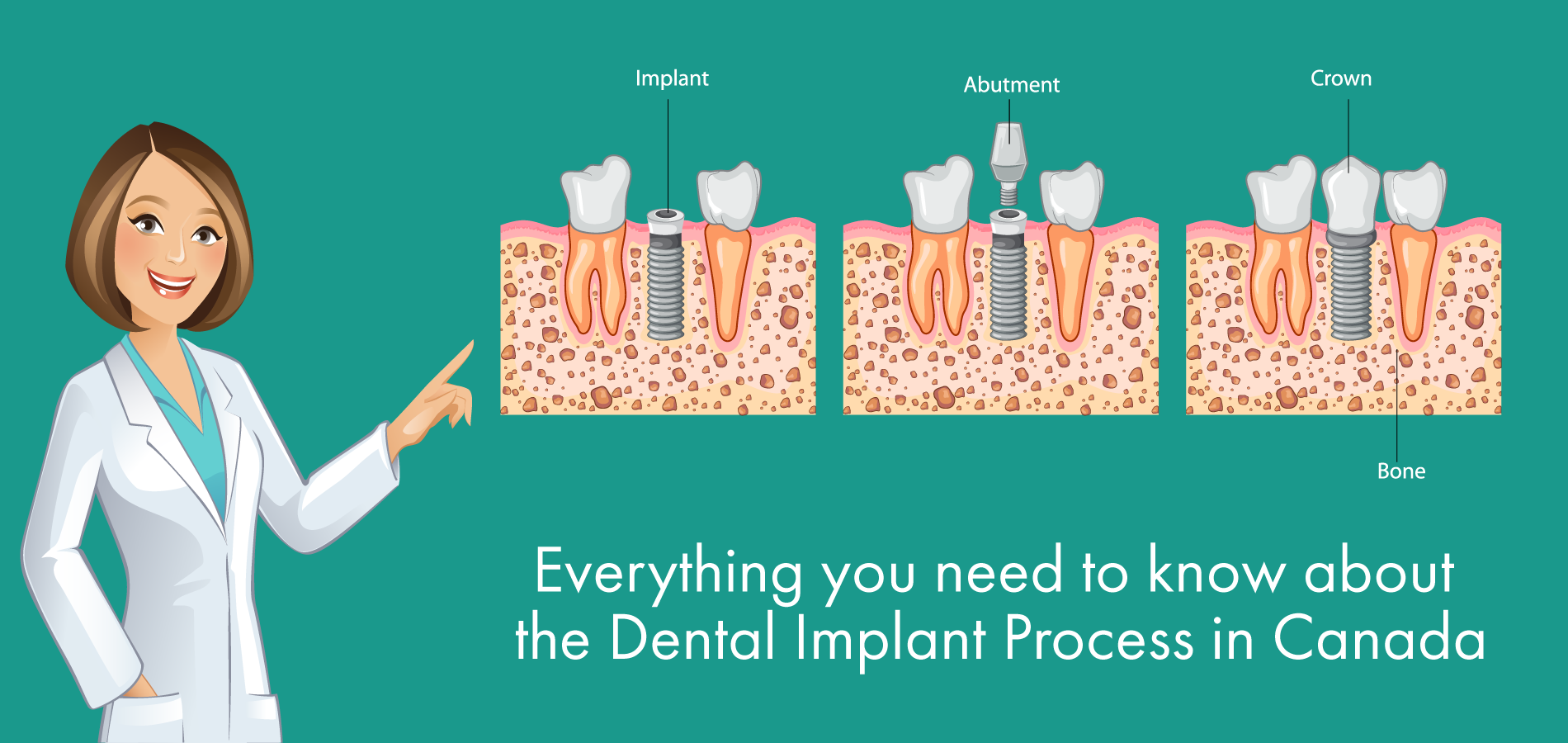

Everything You Need To Know About The Dental Implant Process In Canada

Are Dental Implants Tax Deductible Quora

How To Afford Dental Implants Without Going Broke Dental Implants Dental Implants

Are Dental Implants Tax Deductible Dental News Network

Are Dental Implants Tax Deductible Dental News Network

Are Dental Implants Tax Deductible Drake Wallace Dentistry

Perfit Are Denture Implants And Dental Implants A Cra Tax Credit

Dental Implant Cost Toronto How Much Do Dental Implants Cost

Are Dental Implants Tax Deductible Dental News Network

Is It Worth Having Dental Implants If You Smoke Quora

Periodontic Expenses A Tax Deduction Often Missed Trusted Advisor

Are Dental Implants Tax Deductible Dental News Network

Which Dental Expenses Are Considered Deductible Medical Expenses When Filing Income Taxes 2022 Turbotax Canada Tips

Are Dental Veneers And Implants Tax Deductible

Can I Claim Dental Implants On My Taxes In Canada Ictsd Org